The Shrinking Geography of Opportunity in Metro America

May 10, 2022

By Thai Le, Edward Muña, Sarah Treuhaft, and Rasheedah Phillips*

Contents

- Introduction

- Data and Methods

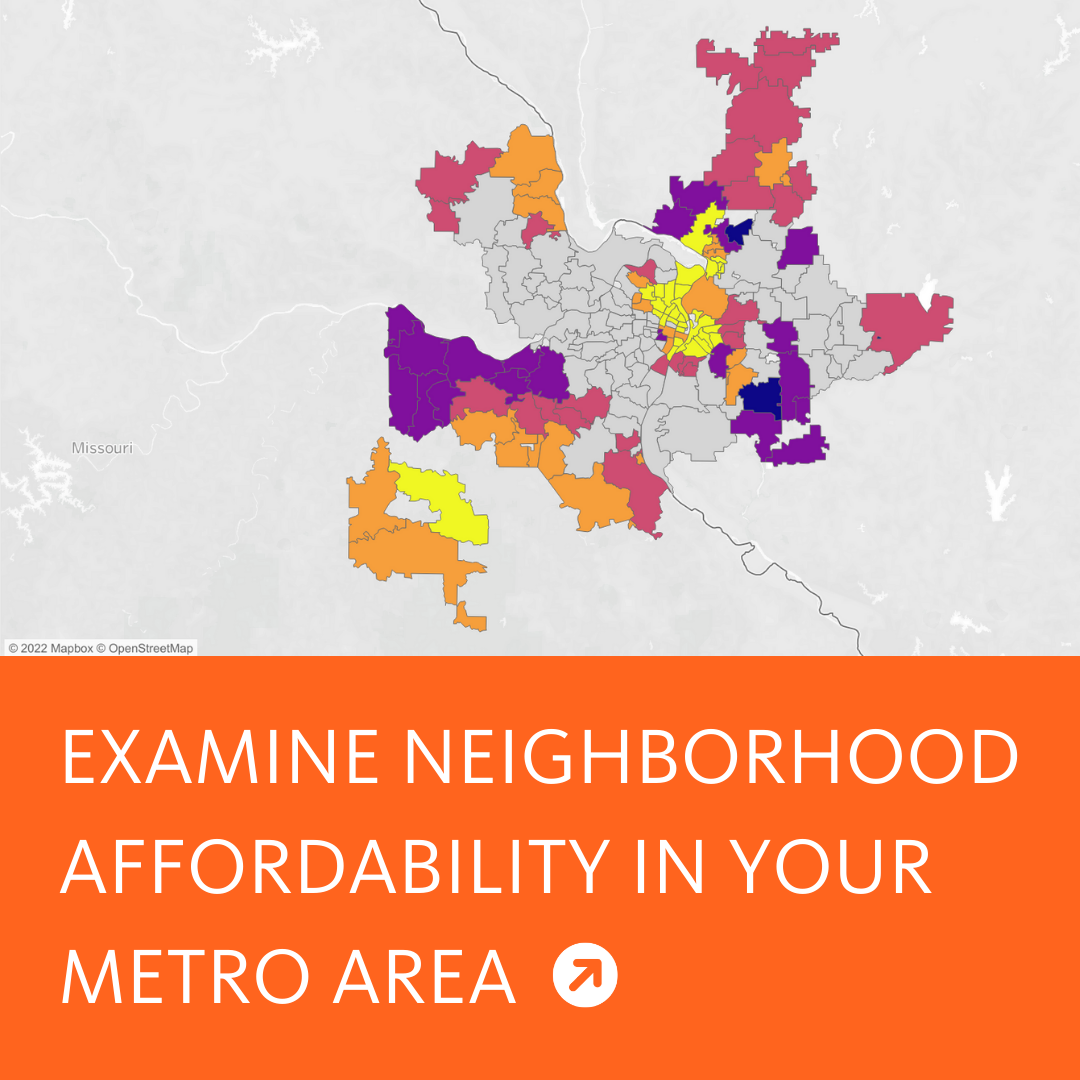

- Interactive Map: Neighborhood Affordability for Renters in Metro America

- Findings

- Renters in Metro America Face Shrinking Maps of Affordable Neighborhoods

- Black Households Have the Fewest Neighborhood Choices

- Black Renters Experienced the Steepest Declines in Affordable Neighborhoods

- The Majority of Neighborhoods Affordable to Low-Income Households Are Lower Opportunity

- Black and Latinx Renters Have Very Limited Access to Prosperous Neighborhoods

- Expanding the Geography of Opportunity Is Key to Shared Prosperity

- Conclusion

- Authors

- Acknowledgments

Introduction

The coronavirus pandemic continues to both illuminate and deepen the challenges of structural racism and housing inequity in the United States. While rent relief programs are sunsetting and rents are skyrocketing, millions of renters negatively impacted by the pandemic’s economic fallout face crushing rent debt, eviction, and homelessness. And the renters who have been hit the hardest are disproportionately people of color and people living on low incomes. This extreme precarity stems from a housing crisis that has plagued communities for decades. At the onset of the pandemic, there was not a single state, region, or county in the US where a full-time worker earning the minimum wage could afford a two-bedroom rental home, and nearly half of Black and Latinx renters (and more than a third of all renters) were paying unaffordable rent.

Not only is there an overall shortage of affordable rental homes, but they are rarely located in “high-opportunity” neighborhoods that have high-quality schools, safe streets, clean air, parks, reliable transit, and proximity to jobs, retail, and services. Instead, they are concentrated in disinvested neighborhoods that lack these “opportunity structures” and are often replete with harms ranging from polluted air to decrepit infrastructure to excessive surveillance and police violence. The overcrowding of affordable homes in lower opportunity neighborhoods and lack of affordable homes in higher opportunity neighborhoods have significant negative consequences for people living on low incomes. Decades of research underscore that living in a neighborhood lacking critical opportunity structures negatively affects health, access to educational and economic opportunities, and life outcomes — especially for children.

This uneven “geography of opportunity,” or access to neighborhood conditions that influence positive life opportunities and outcomes, is a defining hallmark of American metropolitan regions — and it is one that is deeply rooted in systemic racism. In the past, racially discriminatory policies, including redlining, urban renewal, and government-backed home loans (almost exclusively for white homebuyers), created geographic concentrations of opportunity and disadvantage throughout regions. Today, policies that are not explicitly discriminatory yet have racially inequitable impacts (e.g., exclusionary zoning), maintain these patterns of spatial inequality — effectively locking many people of color out of educational and economic opportunity.

This analysis is the first in a series exploring the changing geography of opportunity in American metropolitan regions, building from our earlier analysis of the San Francisco Bay Area. In that study, we found that only 5 percent of census tracts in the region had median market rents that were affordable to a renter household of two full-time workers each earning $15 per hour. Those affordable neighborhoods were located on the outskirts of the region, and 92 percent of them were “low opportunity,” according to the Child Opportunity Index produced by researchers at Brandeis University. Our findings underscored the pattern of regional resegregation in the Bay Area described by Urban Habitat, in which tech-driven growth has been pushing low-wage service-sector workers out of core cities to the outer parts of the region.

Expanding our lens to the largest 100 metros, in this analysis we ask three questions: First, how does neighborhood affordability for low-income households differ across metros? Second, how does neighborhood affordability vary for Black, Latinx, and white households across metros? And third, is the geography of opportunity for low-income households and households of color shrinking over time, restricting housing choices to an even smaller number of neighborhoods far away from the locus of economic activity?

We answer these questions using data on median market rents by zip code from Zillow and metro-level census data on household income overall and for Black, Latinx, and white households for the years 2013 and 2019 to capture the period of economic recovery between the Great Recession and the pandemic. Forthcoming analyses in this series will examine the changing geography of opportunity for Asian and Pacific Islander communities and Native American communities across the country.

Using median market rent as a measure of neighborhood affordability means two important things: First, we are focusing on the costs faced by households searching for available rental housing in a metro, not the cost of all rental housing units in a metro. (In other words, we are excluding the housing units of incumbent renters, which tend to have lower rents.) Second, given that a median means that half of the rents are below it and half are above it, this is a summary measure of neighborhood affordability, not a precise measure. So, affordable rentals might exist in a specific neighborhood, but they are not plentiful.

To examine affordability by race/ethnicity, we define an affordable zip code as one with a median market rent that is affordable to households at the median household income for that racial/ethnic group within that metro. For example, in 2019, 13 of 350 zip codes were affordable to Black households at the median income for all Black households in Chicago ($76,394) and 48 zip codes were affordable to Latinx households at the median income for all Latinx households in Chicago ($101,643). In the proceeding analysis, the terminology “median-income Black households” and “Black households at the median income” refer to Black households at the median household income for Black households within that metro. This is true for Latinx and white households as well.

Data and Methods

We examine neighborhood affordability using Zillow data on median market rents by zip code and 5-year American Community Survey data on household income — overall and for Black, Latinx, and white households — for the years 2013 and 2019, during the economic resurgence following the Great Recession.

The Zillow Rent Index (ZRI) is an index that captures typical market rent. It is broadly available for US geographies and provides data down to the zip code level, which is what we used in this report to approximate neighborhoods (which are generally smaller than zip codes). The ZRI is broadly available for the largest US metros. We found that in 97 of the 100 regions, Zillow’s ZRI data covers at least 80 percent of the renter household population in both 2013 and 2019. The three metro areas with data for less than 80 percent of the renter population are Youngstown-Warren-Boardman, Ohio-Pennsylvania (79 percent); Rochester, New York (77 percent); and Augusta-Richmond County, Georgia-South Carolina (58 percent). The Zillow Rent Index for June of each year (2013 and 2019) was used to determine affordability.

To look at affordability by income level, we considered three thresholds relative to each metro’s area median income (AMI): low income (80 percent of AMI); median income (100 percent of AMI); and moderate income (120 percent of AMI). Using AMI as a reference point allows for regional comparisons that take into account the different costs of living across American metros. We did not examine lower levels of affordability, such as for households classified as very low income (50 percent of the area median income) or extremely low income (30 percent of the area median income), because of the lack of neighborhoods affordable at those levels. Across the 100 largest metros, no zip codes had affordable median market rents for extremely low-income households in 2013 or 2019, and only a few zip codes were affordable for very low-income households in 2013 and 2019 (seven in 2013 and 0 in 2019).

To look at affordability for Black, Latinx, and white households, we relied on median household income (100 percent of AMI) by race/ethnicity (of the householder) within each metro area. Given that metro areas have varying levels of income inequality by race, the range of zip codes with a median market rent that is affordable to the median-income household by race will vary as well.

In examining affordability by income and race, we used median incomes for all households (rather than just renter households) since we aim to examine racial inequity in rental affordability within regions generally and note that homeowners can become renters and vice versa.

Affordable rent is defined as paying no more than 30 percent of household income on rent and utilities — the standard used by the US Department of Housing and Urban Development and many other government and nonprofit housing agencies.

We assessed neighborhood opportunity levels in affordable neighborhoods using the Child Opportunity Index developed by researchers at Brandeis University. This index provides a relative measure of neighborhood opportunity within a metro by scoring neighborhoods (here, zip codes) using 29 indicators of opportunity across three domains: education; health and environment; and social and economic. The final index sorts the nation’s zip codes into five levels of opportunity (quintiles): very high, high, moderate, low, and very low opportunity.

We used Zip Code Tabulation Areas to correspond with Zillow Rent Index Data and Child Opportunity Index Data. Zip Code Tabulation Areas (ZCTAs) are a geographic designation created by the Census Bureau. They are generated with the decennial census and are representations of zip codes that have been assigned to census blocks. Zip codes are defined by the US Postal Service to aid in the delivery of mail. Zip codes can change annually, while ZCTAs are more stable over time. Generally, zip codes do match up with ZCTAs, but there are specific instances where there can be mismatches, including where ZCTAs do not exist for large areas that are sparsely populated or in cases where areas do not have a residential population. Therefore, references to zip codes in the document refer specifically to ZCTAs.

Our key findings include the following:

-

Working-class households face a shrinking geography of opportunity in metro America. Across the 100 most populous metropolitan areas, the number of zip codes where the median market rents are affordable to low-income households declined 50 percent between 2013 and 2019 (from 17 percent of zip codes to 8 percent). The trend of declining affordability was widespread: the number of neighborhoods with affordable median market rents shrunk in 81 metropolitan regions, remained approximately the same in 16 of them, and increased in only three regions.

-

Black and Latinx households have the fewest choices when it comes to affordable neighborhoods. In 2019, only 7 percent of zip codes in the top 100 metros had median market rents affordable to Black households at the median income for all Black households in the metro. For Latinx households at the median income, just 16 percent of zip codes had affordable median market rents.

-

Black households experienced the steepest declines in affordable neighborhoods in the years preceding the pandemic. Between 2013 and 2019 — even as the economy was recovering and median incomes increased for households of all races and ethnicities — the number of zip codes with median market rents affordable to median-income Black households decreased by 14 percent.

-

The majority of neighborhoods affordable for Black, Latinx, and low-income households are lower opportunity neighborhoods. Among the zip codes with affordable rental housing for the median-income Black household, 82 percent were either “low” or “very low” — the bottom two quintiles on the Child Opportunity Index — while only 38 percent of zip codes affordable for the median-income white household were “low” or “very low” opportunity.

While the rental affordability crisis is affecting all households, it is disproportionately impacting low-income renters and renters of color. As market rents have increased, the number of neighborhoods affordable to working-class households in American metros has declined dramatically, contributing to growing economic segregation and further limiting choice, access, and opportunity for the very same people most harmed by exclusionary and discriminatory policies. Black renters, in particular, face an extremely limited — and diminishing — number of neighborhood choices. Shrinking neighborhood affordability in many large metros is both reinforcing long-standing patterns of racial segregation and creating new ones in which low-income Black and Brown working-class households are confined to neighborhoods on the outskirts of prosperous cities.

Although this analysis is based on pre-pandemic data, all signs indicate that the trend of shrinking housing opportunity continues, and, if anything, conditions have worsened. In 2021, rents increased by at least 10 percent in 149 metropolitan regions, whereas only three metros experienced that level of rent growth in 2019. Lower income renters, low-wage workers, and small businesses serving communities of color were hardest hit by the pandemic’s economic fallout. Nearly six million renter households are currently behind on rent — about double the pre-pandemic baseline.

Achieving racial equity and a just economy requires changing this paradigm and ensuring that households living on low incomes can live in affordable homes in neighborhoods that support their health and economic success. This requires a multipronged approach to invest in equitable recovery strategies and enact transformational policies. We recommend four broad arenas for policy action:

-

Keep renters in their homes by making eviction protections and rental assistance programs permanent, and stabilizing rents

-

Preserve and expand affordability in all neighborhoods, including high-opportunity and gentrifying areas

-

Open up access to high-opportunity neighborhoods while investing in the neighborhoods where working-class renters of color already live

-

Improve neighborhood quality where housing is affordable and invest in spatial reparations

Renters in Metro America Face Shrinking Maps of Affordable Neighborhoods

Across the 100 largest metros, the number of neighborhoods with affordable rental housing for low-, median-, and moderate-income households declined between 2013 and 2019. The steepest decline was for low-income households, who saw a 50 percent drop in zip codes with affordable median market rents (about 750 zip codes) — leaving less than 10 percent of zip codes in the 100 largest metros affordable to these renters. The number of neighborhoods affordable to median-income renter households declined by 37 percent (nearly 1,500 zip codes). Neighborhoods with affordable median market rents for moderate-income renter households decreased by 22 percent.

Looking exclusively at neighborhoods affordable to low-income households, we find the following:

The number of metros with no affordable zip codes tripled. Between 2013 and 2019, the number of metros with zero zip codes affordable to these working-class renters increased from 14 to 42. The majority of these unaffordable metros are in California and Florida. Among California’s 11 large metros, only Riverside has any zip codes where the median market rent is affordable to residents making 80 percent of the area median income, and since 2013, the share of affordable zip codes in this region has declined by 75 percent.

Eighty-one of the 100 most populous regions in the United States saw a decline in affordability. This decline ranged from a 48-percentage-point drop in Boise, Idaho (where 48 percent of zip codes were affordable in 2013 but none were affordable in 2019), to a decline of three-fourths of a percentage point in the Boston metro area (from 0.75 percent to 0 percent of zip codes being affordable). On average, these 81 regions saw a 12-percentage-point decrease in the proportion of affordable zip codes. Twenty-eight of these metros became entirely unaffordable with zero affordable zip codes in 2019. In 64 of these metros, zip codes located in principal cities became unaffordable, signaling possible gentrification and displacement of lower income people of color to the outer areas of regions.

Sixteen metro areas saw no change in the number of zip codes affordable to low-income households. The vast majority of these metros (14 out of 16) already had no affordable neighborhoods in 2013, and still had no affordable neighborhoods in 2019. They include many large California metros (Los Angeles, San Diego, San Francisco, San Jose); Honolulu; El Paso and McAllen, Texas; New Orleans; Little Rock, Arkansas; and several Florida metros, including Miami and Sarasota.

Affordability increased in just three metro areas. Only three metro areas saw an increase in zip codes affordable for low-income households: Baton Rouge, Louisiana, (from 2 to 7 percent affordable); Madison, Wisconsin (20 to 24 percent); and Wichita, Kansas (37 to 48 percent). In these three metro areas, there were moderate declines or increases in rents leading to increased affordability. In the case of Wichita and Madison, median household income decreased at a slightly lower rate than rents.

Black Households Have the Fewest Neighborhood Choices

Extreme racial inequities in income contribute to the persistent economic and racial segregation that has long characterized metropolitan housing markets in America.

Examining neighborhood affordability by race and ethnicity across the largest 100 metros reveals that Black households have the fewest neighborhood choices by far: In 2019, just 7 percent of neighborhoods were affordable to median-income Black households and only 16 percent of neighborhoods were affordable to median-income Latinx households. In contrast, the median-income white household could afford 69 percent of the neighborhoods.

Black Renters Experienced the Steepest Declines in Affordable Neighborhoods

Black households experienced the steepest declines in affordable neighborhoods in recent years. During the economic upswing between 2013 and 2019, the number of neighborhoods affordable to Black households decreased by 14 percent in aggregate across the largest 100 metros.

Looking at variation among metros, affordability declined for Black households in 39 of the 100 largest US metros, while affordability only increased in 25 of them. In 2013, there were 40 metro areas where no zip codes were affordable to Black households at the median income, increasing to 48 metros in 2019.

Growing racial income gaps — along with rising rents — have contributed to this decline in access to affordable neighborhoods for Black households. From 2013 to 2019, after adjusting for inflation, the median household income of Black households increased by just $800 compared with about $3,000 for white households and $3,700 for Latinx households.

White households at the median income also saw a decline in affordable neighborhoods (by 4 percent). Affordability decreased in 52 metros, stayed the same in 13 metros, and increased in 35 metros.

Latinx households experienced a slight increase in neighborhood affordability in aggregate across the 100 metros (2 percent more affordable neighborhoods in 2019 compared with 2013). But the local experience is quite mixed: Affordability declined for Latinx households in 39 metros, increased in 38 metros, and stayed the same in 23 metros. In addition, the number of metros where no zip codes are affordable to Latinx households at the median income for all Latinx households in the metro grew from 25 in 2013 to 33 in 2019. The 39 metros where affordability declined for Latinx households include 12 metros with zero affordable zip codes for median-income Latinx households in 2019. This list of 12 includes Los Angeles, Orlando, and Miami — major metropolitan regions with historically large Latinx enclaves.

The Majority of Neighborhoods Affordable to Low-Income Households Are Lower Opportunity

Decades of research demonstrate the importance of neighborhood conditions in determining the health, life chances, and economic mobility of residents — and how Black, Latinx, and other people of color people have been locked out of neighborhoods with well-resourced schools, safe streets, parks, transportation, and other crucial ingredients for social and economic success.

Our analysis of the neighborhoods with rental housing affordable to low-income households reveals that over three-fourths of them (76 percent) were categorized as “low” or “very low” in 2019, according to the Child Opportunity Index produced by researchers at Brandeis University. Among the neighborhoods affordable to median-income households, 56 percent had low or very low opportunity levels. And among neighborhoods affordable to moderate-income households, 43 percent had low or very low opportunity levels. Despite the economic resurgence at the time, there was growth in the number of affordable zip codes falling into the very low category across all income groups from 2013 to 2019, especially for low- and median-income households who saw the number of affordable zip codes in the very low opportunity category rise by 7 percent.

Black and Latinx Renters Have Very Limited Access to Prosperous Neighborhoods

Our analysis also revealed racial disparities in access to neighborhoods that are affordable and opportunity-rich. In 2019, just 6 percent of zip codes affordable to the median-income Black households were high-opportunity zip codes and none were very high-opportunity, while 14 percent of zip codes affordable to the median-income Latinx household were high- or very high-opportunity neighborhoods. This starkly contrasts with affordability for white households for whom just over 40 percent of affordable zip codes were high and very high-opportunity zip codes.

Looking at how access to affordable and high-opportunity neighborhoods has changed over time, we see that although the share of affordable neighborhoods with high- or very high-opportunity levels increased for Black and Latinx households between 2013 to 2019, the majority of zip codes affordable to these households were still low opportunity. In 2019, 83 percent of zip codes affordable to the median-income Black household and 66 percent of zip codes affordable to the median-income Latinx household were either low or very low opportunity.

Expanding the Geography of Opportunity Is Key to Shared Prosperity

This analysis reveals how the rental affordability crisis, driven by systemic inequities and ever-widening income inequality, is disproportionately impacting working-class people and people of color. With the rise in market rents between 2013 and 2019 — a trend that has accelerated since 2021 — the number of neighborhoods affordable to working-class, Black, and Latinx households in American metros has declined. Shrinking neighborhood affordability and the dearth of affordable neighborhoods that provide the necessary conditions for health, well-being, and economic success in many large metros are reinforcing long-standing patterns of racial segregation and creating new ones.

Reversing the trend of shrinking neighborhood opportunity for low-income renters and ensuring that all residents have access to safe and affordable housing in opportunity-rich neighborhoods is crucial to reversing the racial and economic inequities that prevent equitable, prosperous regions. In this moment in which states and localities are deciding how to spend federal “recovery” resources, policymakers should invest in equitable housing strategies. In addition, the pandemic has underscored the need for new and refreshed approaches to housing justice that address the roots of systemic racial inequities, with an ethos of reckoning, repair, healing, transformation, and equity.

We recommend four priority arenas to usher in a more just housing future:

1. Keep renters in their homes by making eviction protections and rental assistance programs permanent, and stabilizing rents.

Shrinking metro maps of affordable zip codes underscores the need for bold policy solutions to protect renters and help them stay in their homes. Short-term eviction moratoria and emergency rental assistance helped stabilize economically insecure households impacted by Covid-19 during the pandemic, and the expiration of those protections puts millions of families at risk of displacement. Moreover, many households could benefit from emergency rental assistance outside of the pandemic. The fact that 36 percent of households do not have enough money to cover a $400 unexpected expense means most households cannot afford the three months’ rent that is often required to secure new rental housing. When emergency expenses arise, these same households are forced to make impossible choices between rent and other expenses. Emergency rental assistance would provide funds for households to cover moving costs in case of an urgent issue like serious repair issues in a unit or help avoid forcible evictions for households with one-time financial crises.

Expanding and making permanent many of the critical renter protections and anti-displacement measures piloted at the height of the pandemic, including eviction diversion, right to counsel, and rental assistance, could help renters living on low incomes weather today’s rental affordability crisis, participate in the recovery, and begin to shape equitable housing futures. When these programs are in place, tenants are far less likely to be evicted and become homeless and are far more likely to secure repairs or negotiate smoother transitions to safe, affordable housing. Beyond the substantial benefits of these programs for individual low-income renters, they also benefit entire neighborhoods, improve the efficiency of local court systems, and thereby save public money. Representing tenants in housing condition cases also prevents neighborhood disrepair by helping to enforce laws that require landlords to maintain their properties.

Many states, counties, and cities have not yet exhausted their flexible American Rescue Plan Act State and Local Fiscal Recovery Fund dollars, and they can use these resources to support eviction prevention as other jurisdictions have done. For example:

-

Connecticut allocated $20 million for legal representation for tenants facing eviction over two years.

-

New Jersey is using $760 million in recovery funds to create an eviction prevention program

-

Minnesota used a portion of its recovery funds to provide an additional three months of emergency rental assistance to households that have exhausted their initial benefits period.

-

Arizona allocated $5 million for Chicanos Por La Causa to hire personnel to assist with rental applications and housing relocation

-

San Diego allocated $85 million for homeless services and $15 million for legal services and counseling for tenants and small landlords.

Additionally, policymakers at all levels should enact rent regulations and just cause eviction protections. They should also support tenant-serving organizations. Tenants living in rent-regulated units move less frequently, are less likely to experience destabilizing forced moves, and pay substantially less than tenants in nonregulated units of similar size and quality. The stability and affordability provided by rent control would have cascading benefits for communities and our broader society. Renters would be more financially secure, with more disposable income to spend on other household needs and in the local economy. They would be healthier since housing stability and affordability contribute to mental and physical health. Children would do better in school since frequent moves disrupt education. Similarly, just cause eviction protections have been shown to reduce displacement. These protections prevent landlords from evicting tenants in order to raise rents, and they should be embedded in rent regulation laws. Tenants should also be protected against landlord retaliation for making complaints, withholding rent until repairs are made, or otherwise asserting their rights under the law. Well-designed code enforcement policies that compel landlords to maintain safe and habitable housing while keeping current tenants in place are critical complements to rent regulation policies.

2. Preserve and expand affordability in all neighborhoods, including high-opportunity and gentrifying areas.

Rising rents along with the decline in affordable zip codes and exclusion of Black and Latinx renters from high-opportunity neighborhoods will leave many displaced renters with no good options — or no options at all — if they are forced to move. Preserving existing affordable housing units and constructing new affordable housing is crucial to meeting low-income families’ housing needs and building a more equitable housing system. This should include expanding community ownership models, such as community land trusts and tenant/community opportunity to purchase (TOPA/COPA), and increasing funding for affordable and subsidized housing production and preservation.

Several cities and states demonstrate how recovery funds can be used for equitable land and housing acquisition and the development and preservation of affordable rental and homeownership opportunities:

-

Rhode Island allocated $12 million in recovery funds to the Rhode Island Housing and Mortgage Finance Corporation to acquire properties for redevelopment as affordable and supportive housing

-

Chesterfield County, Virginia invested $4 million into a housing trust fund to create stable housing for low-income communities disproportionately impacted by the pandemic.

-

Kansas City, Missouri will add $12,500,000 to its new housing trust fund to support the production of new affordable housing units

-

Hamilton County, Ohio, used ARPA funds to allocate $20 million toward the production of new multifamily and single-family affordable housing for low- and moderate-income households.

When implementing these strategies, governments must also seek to end support for, and sales to, predatory corporations buying up homes and communities through land bank sales, local legislator control over land-use decisions in their districts, sheriffs’ sales, and other processes that strip Black and Brown communities of their assets and housing opportunities.

Significantly increasing the supply and availability of housing choice vouchers and other tenant-based subsidies is another important strategy to expand affordability across neighborhoods. At the federal level, the bipartisan Family Stability and Opportunities Act would fund 500,000 vouchers and mobility counseling. Cities and counties can also use ARPA funds for this purpose: San Diego allocated $10 million for housing vouchers and rent subsidies, the District of Columbia allocated $2 million for a community land trust, and Bloomington, Indiana, funded a new landlord risk mitigation program to increase landlord participation in rental assistance programs, including the Housing Choice Voucher program.

For vouchers to succeed, protections must be in place to counter the discrimination that voucher holders often face when trying to access housing in high-opportunity neighborhoods. While the federal Fair Housing Act does not provide a federal source of income protection (except under limited circumstances), an increasing number of states and municipalities have passed laws that prohibit landlords from discriminating against tenants based on their source of income, which protects tenants who participate in the Housing Choice Voucher Program or who wish to use nontraditional sources of income to pay their rent, such as child support and alimony payments. Localities have also utilized the Affirmatively Furthering Fair Housing process to develop strategies for increasing voucher mobility, mobility counseling, and landlord outreach. Similarly, Small Area Fair Market Rents (SAFMR) also provide an opportunity to increase mobility and usage of Housing Choice Vouchers in areas of high opportunity, but they should be administered strategically to ensure SAFMRs do not lead to further disinvestment and landlord participation in low-opportunity areas.

3. Open up access to high-opportunity neighborhoods while investing in the neighborhoods where working-class renters of color already live.

In addition to protecting tenants and producing and preserving affordable housing, expanding the maps of where working-class renters and renters of color can live in American metros requires strategies to expand opportunities in the neighborhoods where low-income renters are already living and to open up access to high-opportunity neighborhoods, including equitable reform of exclusionary zoning practices and increasing affordable housing options in high-opportunity neighborhoods.

Recognizing how local land use and zoning laws that prevent the construction of multifamily housing have contributed to racial exclusion and segregation, the city of Minneapolis and the states of California and Oregon have eliminated single-family zoning which only allows for one unit to be built on a lot. Removing such restrictions that make it impossible to build affordable homes is a critical step to opening up high-opportunity neighborhoods, and such land-use reforms need to be paired with affordable housing investments or requirements to deliver on their promise.

Inclusionary zoning policies are important to address opportunity-hoarding that drives inequalities and ensure affordable homes are built in higher-opportunity neighborhoods. As of 2019, inclusionary housing policies existed in 734 jurisdictions across 31 states and the District of Columbia. Overwhelmingly, these policies have been found to benefit entire communities, not just the people accessing affordable homes. For example, mixed-income neighborhoods create housing near job centers and transit corridors, helping to reduce greenhouse gas emissions from commuting and increasing transit ridership. Studies have shown that the children of families who move to high-opportunity neighborhoods are more likely to attain higher education, enabling them to have increased average earnings by 31 percent in later years.

For inclusionary zoning policies to be successful, they should be mandatory. The success of France’s two-decade-old national mandate for affordable housing availability across neighborhoods illustrates how robust, enforceable state- or national-level mandates could open up opportunity-rich neighborhoods for lower income renters, addressing segregation as well as affordability.

Federal policies are also needed to tackle the many policy and political barriers to building affordable housing in opportunity-rich neighborhoods. The Biden Administration should fully reinstate and ensure full implementation of the Department of Housing and Urban Development’s 2015 Affirmatively Furthering Fair Housing (AFFH) rule’s full and robust framework that would enable communities to assess systemic barriers to fair housing, and design strategic solutions to those problems. It also emphasized meaningful engagement with impacted communities and provided a strong tool to analyze and mitigate the effects of segregation.

4. Improve neighborhood quality where housing is affordable and invest in spatial reparations to address past harms caused by targeted disinvestment.

Decades of discriminatory zoning practices, federal discrimination, urban renewal, and historic disinvestment in communities of color have led to large disparities in neighborhood housing quality, and disproportionate exposure of Black and Brown communities to climate-related disasters, environmental pollution, or co-location to toxic waste sites. In neighborhoods across the country, local governments conspired with businesses to locate polluting operations — roadways, highways, industrial plants — in redlined communities. As a result, Black, Brown, and Native American people face greater exposure to noxious pollutants and allergens which can have immense negative health impacts — particularly on children — and which contributed to higher rates of Covid-19 infection and death in these same communities. A recent study, for example, found that Black and Latinx Americans live with more smog and fine particulate matter from cars, trucks, buses, coal plants, and other nearby industrial sources in redlined areas. Residential segregation is also closely related to food access, nutrition, and health. Even when adjusting for individual education, income, and employment status, people living in racially and economically segregated neighborhoods have higher instances of heart disease and cancer.

The pandemic underscored the need for approaches to housing development and infrastructure building that address the roots of systemic racial inequities. The National African-American Reparations Commission calls on policymakers to “invest in spatial reparations” which they define as “a restorative and reparative geography of socioeconomic and political opportunity, particularly for those displaced and dispossessed by American slavery and their descendants.” Every city and county in this country faces the challenge of eliminating racial inequities, and every city and county should use recovery resources to remove barriers to full participation and proactively advance racial equity and inclusion.

At the federal level, programs like the Reconnecting Communities Program in the Infrastructure Investment and Jobs Act (which will remove or mitigate sections of highways that destroyed communities) can serve as a form of spatial reparations targeted to address the impacts that ill-planned infrastructure investments have had on Black and Brown communities, and how to fund those communities to design and implement local solutions that build the leadership of and center those most impacted. For example, communities in the Claiborne Corridor of New Orleans who are impacted by the I-10 highway are using cultural strategies to prevent displacement and revitalize the space under the highway. Using funding from a city grant, the community has transformed the space beneath the expressway into a cultural and communal space.

Cities are also launching local reparations programs to begin to redress discriminatory housing policies. Evanston, Illinois, recently established a Restorative Housing Program fund to provide Black residents with $25,000 grants for homeownership as a form of reparations for housing discrimination via racist zoning in place from 1919 to 1969. And in July 2020, Asheville, North Carolina, began the process of establishing a community reparations program focusing on redressing the harms of its urban renewal program in the 1960s and 1970s. Recognizing that past city policies caused significant and irreparable harm to Black residents, many other cities are considering local reparations programs. These types of programs and strategies should be fully supported by federal, state, and local dollars for infrastructure and recovery.

Conclusion

The crisis of housing affordability remains an urgent challenge for communities across the country, and it is being driven by both national and local forces. As our analysis shows, there is a growing gap in access to affordable housing and high-quality neighborhoods for working-class renters and renters of color. Protecting renters at risk of eviction and ensuring all households have access to safe and affordable housing is key to an equitable recovery and a strong economy built on shared prosperity.

Authors

Thai Le, Postdoctoral Fellow, USC Equity Research Institute

Edward Muña, Project Manager, USC Equity Research Institute

Sarah Treuhaft, Vice President of Research, PolicyLink

Rasheedah Phillips, Director of Housing, PolicyLink

Acknowledgments

We appreciate the many individuals and advisers who provided invaluable guidance and insights on this research. A special thanks to our amazing colleagues, Justin Scoggins of the USC Equity Research Institute (ERI) and Michelle Huang, Abbie Langston, and Jennifer Tran of PolicyLink, for their research and data visualization contributions to this report. We also thank Andrew Aurand and Dan Emmanuel of the National Low Income Housing Coalition and Phil Tegeler of Poverty and Race Research Action Council for their thoughtful reviews and suggestions.