PolicyLink Urges FTC and CFPB to Unlock Tenants’ Housing Futures

At the beginning of this year, the Biden Administration made a historic declaration in the Blueprint for a Renters’ Bill of Rights, uplifting tenant protections that are vital to addressing our nation’s housing crisis. This Blueprint for a Renters’ Bill of Rights was largely influenced by national organizing led by the Homes Guarantee campaign, in collaboration with other organizations like National Housing Law Project, Lawyers Committee for a Civil Rights Under Law, and PolicyLink, in addition to listening sessions that the White House held with organizers, tenants, and advocates.

On February 28, 2023, the Federal Trade Commission and the Consumer Financial Protection Bureau published a Request for Information on the housing application and background check process, or “tenant screening.” The RFI generated over 500 public comments, many of them highlighting the significant challenges that renters face when applying for housing.

On May 30, 2023, PolicyLink submitted our comment to the FTC and CFPB and encouraged regulators to take a multidimensional approach to equity in consideration of policies and practices that can improve the rental application process. We identified some of the following issues in our public comment:

- About 90 percent of landlords have reported using screening practices (such as checking an applicant’s previous evictions, income, job and rental history, credit scores, and criminal backgrounds) to make housing decisions that systematically deny access to housing for low-income people and disproportionately more Black and Latinx people. These adverse housing decisions have the potential to affect families and their quality of life for generations to come, even though studies have shown these screening practices hold little to no predictive value for a tenant’s housing outcomes.

- The overrepresentation of Black and Latinx individuals in the carceral system as a result of historically racist over-policing and surveillance practices has led to a disproportionate amount of Black and Brown individuals with an arrest or criminal history record. Regardless of any discriminatory intent, screening practices based on criminal history have a disparate impact on Black, Latinx, and LGBTQIA+ individuals who are more likely to receive adverse housing decisions, even though federal guidance has suggested criminal history records are inaccurate and full of errors.

- Every year, an average of 3.6 million people experience an eviction filing, and a disproportionate amount of Black and Latinx households, especially Black and Latinx women, are filed against every year. The record of a sole eviction filing has the capability to lock people out of safe affordable housing opportunities for years and drag families into cycles of poverty, even though many of these records are inaccurate and incomplete.

- Tenant screening companies have created algorithmic technologies trained on data that over-represents protected classes and on records that have been widely known to provide inaccurate information. Regardless, tenant screening companies have continued to employ obscure technological practices to conduct tenant screening without external oversight and regulation and without a robust process for tenants to correct errors found in their reports.

As part of PolicyLink’s ongoing work to lift up tenant screening and eviction records protections and practices that expand housing opportunities and prevent displacement of low-income communities of color, we also:

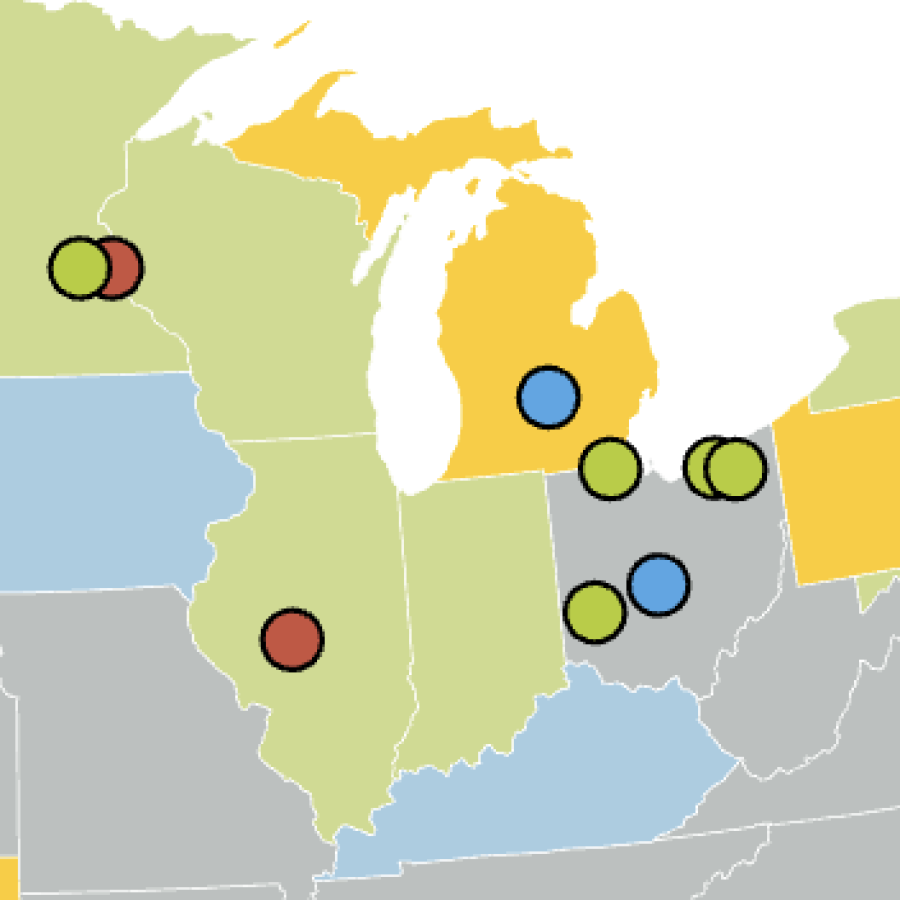

- Released a new tool in the Housing Anti-Displacement Toolkit on eviction record sealing and tenant screening regulations and a map tracking the jurisdictions where these policies have taken off.

- Released Stop Tenant Screening.org, a comment portal aimed to support tenants across the country to share their stories about their housing application and background check experience (in partnership with Upturn and People’s Tech Project).

- Hosted a webinar on the Fair Housing issues presented by discriminatory tenant screening practices in partnership with Upturn.

We are also deeply grateful for the deep expertise of our partners at the Homes Guarantee Campaign, National Consumer Law Center, National Housing Law Project, Upturn, TechEquity Collaborative, Right to the City, People’s Tech Project, Alliance for Housing Justice, Poverty Race and Research Action Council, Alliance for Housing Justice, and the National Fair Housing Alliance for their continued research and advocacy to improve housing access for people of all backgrounds.

For more information on tenant screening and fair housing issues, check out some of our partner’s resources and publications:

- NLIHC: Toolkit on Eviction Record Sealing and Expungement Protections

- Upturn: How to Seal Eviction Records

- TechEquity Collaborative: Tech, Bias, and Housing: Tenant Screening

- NCLC Report on rental debt

- NCLC FTC/CFPB RFI Comment Letter

- PRRAC FTC/CFPB RFI Comment Letter

- HUD AFFH Page

If you experience an adverse housing decision and would like to file a complaint, the CFPB, FTC, and US Department of Housing and Urban Development (HUD) have complaint portals available: