Since his election in 2014, Mayor Ras Baraka of Newark, New Jersey, has been a vocal advocate for equity and inclusion, leading several initiatives to increase access to opportunity for those who are too often locked out and left behind. Two such initiatives are Newark’s municipal identification card program and My Brother’s Keeper Newark (MBKN). The Newark ID program, which will launch this summer, will help undocumented immigrants, the recently incarcerated, and other residents who face barriers to obtaining government IDs connect with vital city resources and engage in civic life. MBKN, which was established in 2014, is a comprehensive program to eliminate the gaps in opportunity and achievement for boys and young men of color in the city.

PolicyLink Founder and CEO Angela Glover Blackwell spoke with Mayor Baraka about these two programs.

Angela Glover Blackwell: You are leading on all the issues that are vitally important to PolicyLink, where our mission is to advance a new generation of policies that achieve racial equity in America. So there are many things to lift up. Municipal ID programs have been used in several cities across the country to help remove barriers to civic engagement for residents, particularly undocumented immigrants. What were the primary drivers in establishing a municipal ID program in Newark?

Ras Baraka: Newark has a very huge population of immigrants and a lot of undocumented residents, who are basically in the shadows. We are trying to make them feel welcome in our community. A municipal ID has incredible social and economic benefits for our city: it allows people to be a part of the infrastructure of our community, to participate in the city services, to report crime without being afraid, to enroll their kids in schools, to put money in the bank, and to open up businesses in our community. It allows them to live without the threat of harassment and intimidation and all kinds of other things that prevent them from being full residents of our city.

Blackwell: Did this program result from a push from the community or was it something that came out of your past community work and engagement?

Baraka: I think it [stemmed from] the President's push around immigration and my ability to connect with other mayors. I went to an event in New York City sponsored by Mayor DeBlasio with a few mayors from around the country. [We talked] about how to push the immigration policy locally and one of the ideas was the municipal ID. I thought that was an incredible opportunity for us in the City of Newark to take advantage of. Our partners here in the city were already doing work on the ground around immigration rights and we brainstormed. We used some of the folks from New York City [who had worked on the NYC ID] to help us think about what it would look like in Newark. And we engaged the community every step of the way.

Blackwell: How does the ID program fit into your larger vision for Newark?

Baraka: America is a country of immigrants… and ex-slaves. My father used to say, “If everybody went back to where they came from, the airports would be crowded!” And a lot of these cities that were suffering economically, the immigrants who came to these communities actually helped stabilize economically by opening up stores and engaging in the economy. They just don't get credit for it. We believe in democracy here in Newark and so we support the idea of people participating fully in democracy and [these IDs] are a way we can offer that to them. This is a progressive thing to do, it's a democratic thing to do, it's the humane thing to do, and so we're trying to get it done.

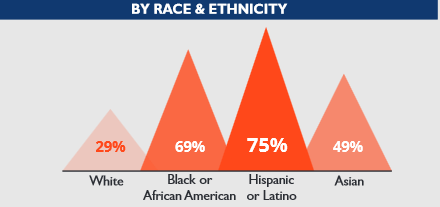

Blackwell: For years now, the focus of our work at PolicyLink has been emphasizing that equity is the superior growth model for the future. That is, given the deep economic crisis that the nation is still in, and the nation’s shifting demographics, if we get it right for people of color who are the majority in many cities and becoming the majority in the entire nation, then we get it right for the nation and our economy. It seems that you envision the ID as having an economic impact not only for cardholders, but having economic benefit for the larger community — is that right?

Baraka: In America now, its future is inextricably tied to these communities of color. The demographics of this country are not changing — they have changed…even more rapidly than people suspected. And the contribution [of communities of color and immigrants] to the economy, to the social fabric of this nation, is undeniable. In order to save this country, we have to back off of these conservative ideas and policies that are preventing us from taking advantage of the wealth of [human capital] resources that are here in our community.

Blackwell: I want to shift to My Brother's Keeper. You recently launched My Brother’s Keeper Newark in response to the President's call for action for addressing the persistent opportunity gaps faced by boys and young men of color. Newark is still in the process of selecting the specific indicators and the goals that you'll target. In this process, how are you ensuring that the community's voice remains part of the planning and implementation process?

Baraka: We have a [My Brother’s Keeper] board of trustees that is made up of different community partners and community folks that create policy around the initiative here in Newark. We also have regular community meetings with the kids and their parents about some of the things that we're doing. All of those things are important so that the My Brother's Keeper guys are involved in helping us to transform the city.

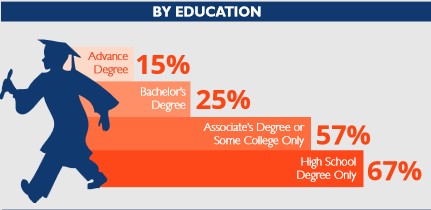

Blackwell: In Newark, 95 percent of young men of color want to go to college, but sadly only 8 percent actually do. When you're thinking about your interventions in the My Brother’s Keeper work, how do you envision making the crucial link to post-secondary education for these young men?

Baraka: We have something that's called the Newark City of Learning Collaborative where we have set a goal that we're going to make sure 25 percent of our residents have post-secondary degrees [by 2025]. Right now we're at 17 percent overall, and like you said, for African American males, that number is smaller. So we are focusing heavily on galvanizing all of the resources we have in our community to create a pipeline from elementary school to college, especially with these young men. [We use] things like college fairs, after-school programming, mentorship, and tutoring. There’s also an executive order that I signed that allows every individual in every department in the city to spend two hours a week in a K-3 class to help mentor.

Blackwell: That is very exciting! I want to step back and talk about how this initiative fits into the longstanding issues of incarceration and violence. In many Black communities, incarceration and violence have created a legacy of absence because the men — the fathers, brothers, husbands, partners, uncles, earners, leaders, and mentors in the community are either dead or behind bars. As a New York Times article pointed out a few weeks ago, about one in six young Black men are missing from their communities for these reasons. What role do you envision Newark’s My Brother’s Keeper work will play in addressing such a complex and pervasive problem in Newark?

Baraka: Well, My Brother’s Keeper does what some communities in other areas already do: they wrap their services and their arms around their young people, protect them, and raise them collectively. They support them so they become successful, and if they make mistakes — like normal teenagers do — they're able to get back up. I think My Brother's Keeper does that and it sheds light on the dismal data surrounding men of color in this country in terms of graduation rates, employment rates, and college attainment rates. This has not been addressed at a federal level… but this initiative gives us the opportunity to address it, to galvanize resources around this issue and begin to help young men of color navigate the problems that exist in their neighborhood[s] and their lives, and [ultimately], helps them be successful.

Read more about the municipal ID program and how My Brother’s Keeper is advancing economic opportunities for boys and men of color in cities around the country.

Read the rest of the June 26, 2015 America’s Tomorrow: Equity is the Superior Growth Model issue.